For a couple of weeks now, the streets and social media circles of Cameroon’s major cities have been buzzing with a single topic: the taxation of income generated through digital mobility platforms. Between rumors of strikes and misunderstandings regarding app commissions, a sense of tension has gripped the ride-hailing sector. However, behind the headlines lies a specific fiscal mechanism that, when stripped of speculation, reveals a structured shift in how Cameroon’s digital economy operates.

To navigate this transition, it is essential to move beyond the noise and look at the facts. The measure currently making waves is not a private fee, nor is it a sudden whim of the digital platforms. It is a government-mandated fiscal policy designed to formalize a sector that has become a vital part of the national economy. The taxation of income earned via digital platforms was first introduced by the Cameroonian government in the 2024 Finance Law. At that time, the state established the principle that individuals earning money through digital interfaces—whether in transport, services, or commerce—should contribute to the national treasury. The only lapse was at the level of how this money would be collected, a situation which the 2026 Finance Law thus clarifies, adjusts, and operationalizes following consultations and refinement by the government.

Understanding the 1% Rate

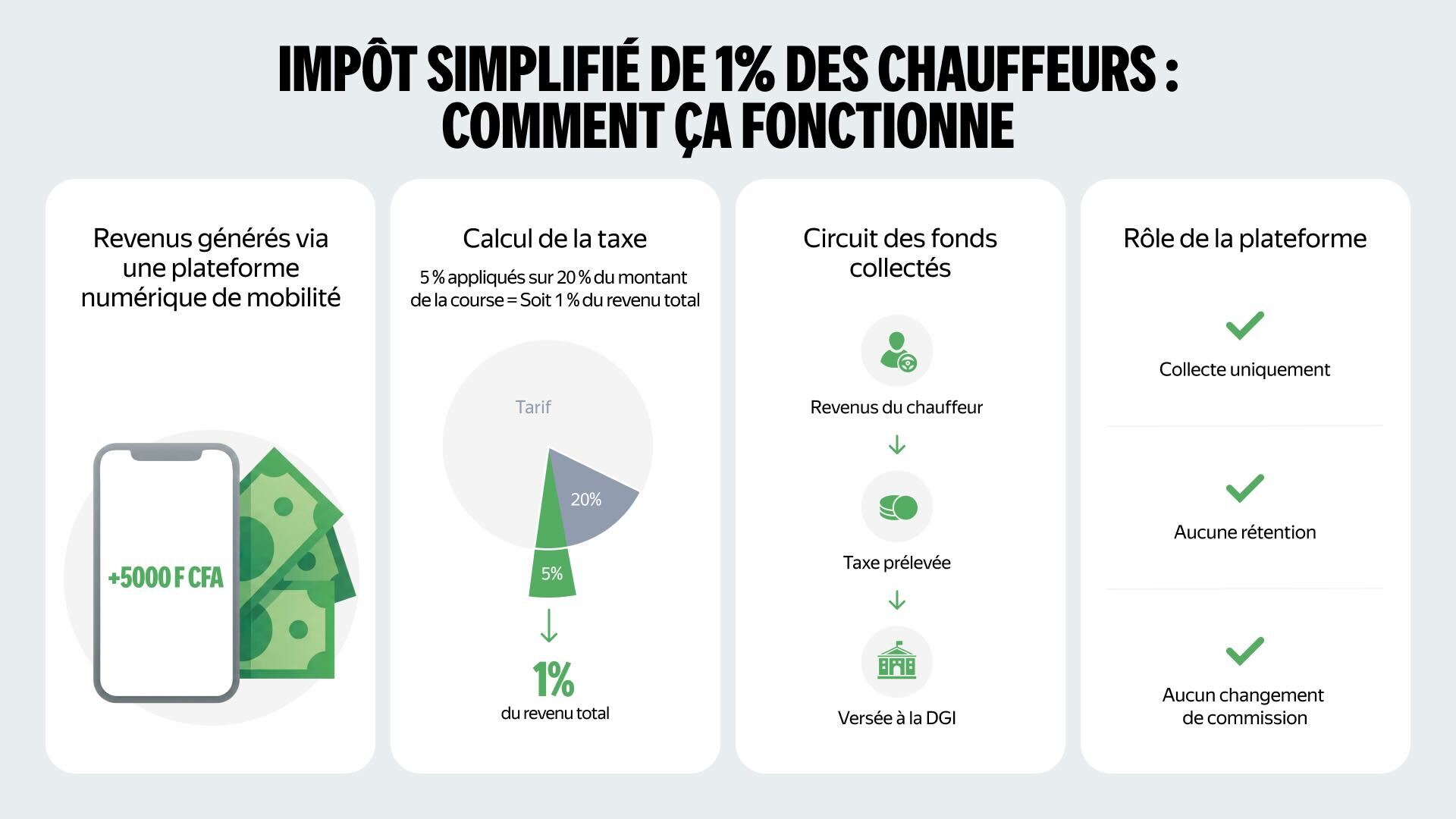

For many drivers, the primary concern is the impact on their daily take-home pay. The tax authorities (DGI) have opted for a simplified approach to keep the burden manageable for independent workers. The calculation of this tax works on two-step logic, firstly a 20% taxable portion is placed on the gross amount generated per trip and then a 5% tax is applied to that specific 20% base. This reflects an effective tax rate of approximately 1% of the total gross income earned by the driver. For example, on a trip totaling 2,000 FCFA, the tax would amount to roughly 20 FCFA. This simplified system was designed to reflect the thin margins often found in the transport sector while ensuring that digital earners are integrated into the formal tax system.

It is worth noting that platforms like Yango, Gozem, or other mobility apps operating in Cameroon, are not the beneficiaries of this money, they are simply collection agents as designated by the General Directorate of Taxation (DGI). This means no increase in service fee or commission, the totality of the collected tax is transferred directly to the DGI. By deducting the tax at the source, the system spares individual drivers the administrative burden of filing complex monthly tax returns themselves.

This role is part of a broader international trend where tax authorities leverage digital intermediaries to streamline revenue collection in the gig economy. It ensures that the tax is collected transparently and reaches the state coffers without intermediaries losing any portion along the way. It is a mistake to view this as a measure targeting a specific company. This tax is ecosystem-wide. It applies to every digital mobility platform operating within the national territory and every independent driver using those platforms to generate income.

The objective of the DGI is to ensure “fiscal equity.” In a traditional taxi or transport business, operators are subject to various local and national taxes. By implementing this 1% measure, the government is ensuring that the digital transport sector—which has grown exponentially over the last five years—operates on a level playing field with traditional sectors.

Toward a Calmer Dialogue

Transitions in fiscal policy are rarely without friction, especially in a sensitive social climate. However, much of the current frustration stems from the belief that platforms are unilaterally raising their prices or that a “new” burden has been suddenly dropped on the sector.

The reality is one of formalization. As Cameroon’s digital economy matures, it must move from a “grey zone” into a structured framework. By understanding that this is a state-led initiative, that the rate is set at a manageable 1%, and that platforms are merely the conduits for the DGI, the public debate can shift from speculation to informed adaptation.

As these measures become operational, the focus remains on ensuring that the digital economy continues to provide opportunities for thousands of Cameroonians while contributing its fair share to the nation’s development.