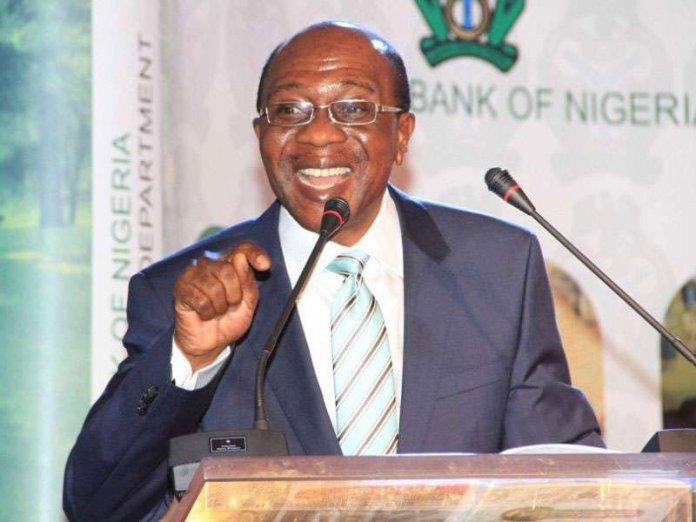

The Central Bank of Nigeria (CBN) has raised the Monetary Policy Rate (MPR), which measures interest rate from 16.5 percent to 17.5 percent to check inflation in the country.The Governor of the CBN, Mr. Godwin Emefiele, told journalists on Tuesday after the Monetary Policy Committee (MPC) meeting of the apex bank in Abuja that the MPC raised the monetary policy rate by 100 basis point to 17.5% and kept the asymmetric corridor at +100/-700 basis points around the MPR.

He stated that the committee retained the Cash Reserve Ratio (CRR) by 32.5 percent, while the liquidity ratio is kept at 30 percent.

According to Emefiele, the members of the committee welcomed the recent deceleration of the year-on-year headline inflation and that the persistence in policy rate hike over the last few meetings of the committee have started to yield the expected decline in inflation.

“The MPC was of the view that although inflation rate moderated marginally in December, the economy remained confronted with the risk of high inflation with adverse consequences on the general standards of living.

“The Committee, therefore, decided to sustain the current stance of policy at this point in time to further rein in inflation aggressively.

“MPC voted to raise the MPR to 17.5%, retain the asymmetric at +100/-700 basis points around the corridor,” he said.

Speaking of the redesign of the Naira notes, Emefiele said that the committee members agreed that the naira redesign has huge moderating factors to price development on cash.

He said that there would no shift on the deadline for exchange of the old Naira notes and that its January 31, 2023 deadline for the validity of the old N200, N500 and N1,000 notes has not changed.